Tax Audits by CRA in Small Business

- June 26, 2021

- Posted by: Arun Kirupa

- Categories: Blog, Finance & Accounting, Taxes and Government Compliance

How to handle tax audits effectively and efficiently.

Published on June 25, 2021 by The Live CFO

When you receive a telephone call or letter from CRA regarding an audit, time and how you reply are significant with detrimental effects if not fulfilled. You will usually have to respond within 30 days and if accorded an unfavorable decision, appeal should be made and submitted within 90 days. There will always be an option for you to liaise by and for yourself. With this come the mental load and the different kinds of stress that will ruin your peace of mind. Let an experienced accountant bear this stress and ensure that you get the most favorable results by maintaining your legal rights. You can continue focusing on your business while we ensure your government compliance is kept tip-top.

What is a Tax Audit?

A tax audit is an inquiry to a taxpayer’s books of transactions and finances to verify the accuracy of the amount of tax due and paid by the taxpayer in the periods covered. It forms part of the policing power and taxing power of the government; it is a legal obligation for the taxpayer to comply and cooperate. The usual duration for the transactions to be audited is three years from the time the notice of assessments has been issued. This means all files, documents and proofs to substantiate what has been declared in those years are required to be reproduced and exhibited to ensure accounting transparency and transaction legality as to their effect on the business’ income and taxes.

How are businesses chosen to be audited?

Most commonly used methods are as follows:

● Computer-Generated

With the use of innovative algorithms that are coded to find anomalies using indicators such as cash flow patterns, syndicated models, industry statistics, unfulfilled tasks in the common industry-specific checklists and use of different payment means. Knowing these intricate details is the job of your accountant, if you have one hired or retained.

● Leads

It is common for CRA to obtain leads, either externally or through the previous audits they have made to use the same as basis and cross-verification that may lead to finding significant discrepancies in your transactions on your declared report. Sources can be the report from your other businesses, previous partners, employees bearing grievances or anonymous complaints about you or your business

● Selected Industry or Audit Groups

Through intelligence, CRA identifies various practices deemed to be aggressive tax planning or non-compliance of tax laws. Under those circumstances, CRA will start auditing businesses in identified industries or groups of business. Sometimes being in an industry that shows non-compliance in the current taxation laws may be the actual reason why an audit is requested for you to undergo.

● Tangential Relations

The CRA may decide to include ancillary persons or businesses of one entity already being subjected to an assessment. This means that any partner, associate, clients, suppliers, management staff or others who could have made use of the transaction in question to preserve or gain from the same to be included in a separate audit of each person or business’ involvement.

How does the CRA conduct audits?

Auditors would review various transactions, books, records, documentations and statements for the relevant periods in questions. This can include not only the cash flow proofs in the business but also personal life of the owners and their families. By law, one should be keeping all financial records that may be requested for review as the subject of an audit. Review of these files may take weeks to several months as deemed fit by the auditor, taking into account the volume, complexity and jurisdiction of the transactions. Generally, the following can be requested and subjected for review:

● CRA File, previous audits made, returns submitted, financial statements

● Business transaction records such as bank statements, general journals and ledgers, bank books, automated and paper-based invoices, any receipts that were issued or acquired during the audit term

● Incorporation documents, corporate agreements, business contracts and documents

What are the different types of CRA audits?

Some of the most common audits a small business may go through are follows:

● Personal Tax Audit

These are done to verify tax credit requests or applications which entail that most of the same are done with restrictions to an item or two with limitations on the scope. There may also be an assessment pertaining to an individual’s net worth; the CRA will cross-verify the increase or decrease in the assets and liabilities to eventually determine the end income. The audit of the 2nd kind is serious and is in need of focus and expertise in addressing. The first kind can be changed to an overall assessment with unrestricted scope when the CRA is not convinced with the files provided to substantiate the claim.

● Corporate Tax Audit

The gravest kind of assessment is a corporate tax audit due to an all-encompassing purpose; you will be open to a catch-all reason to find faults. Due to the exposure of the company, preparations may take weeks, while the audit may take months and possibly years. The auditor has the right to question all items or documentation at sight as to purpose and the effect on cash flow and overall value of the company and the different interests at play. If you are at the height of the demand for your service or product, the legal obligation to accommodate this government compliance may take a toll on your operations, despite being administrative in nature, hence it is a must for you to think of ways to ensure your business is protected in all fronts by a very respected CRA audit expert like us here in The Live CFO.

● Payroll and Source deduction Audit

The lack of withheld tax forwarding to the CRA, late filings and deferens on filings may spark an inquiry to an audit. If you employ people, there are administrative expectations: the need to deduct tax payment as computed according to the income tax law, and eventually forwarding the same to the CRA, for example. To prevent this type of audit from happening, correct calculation, deduction and substantial record keeping should be the norm in your business. We specialize in these kinds of auditor transparency meetings to ensure we provide valid explanations on what you have done in the past, what your present options are and what to look forward to, for you and your business in the future.

● GST/HST Audit

Being in business of products subject to GST or HST means your business should have in-depth knowledge as to what tax/taxes are to be passed to the end-consumer and the right calculation on the amount you will charge. Your records should show accuracy and should match across all returns made, income, GST/HST and the likes. If you have a transparent and accurate record-keeping habit, this kind of audit can be resolved on its own for the inquiry’s purpose is cross-validation at its core. Most corporate audits that resulted in a tax liability where the business ended up owing the CRA funds would most likely be followed up with a GST/HST audit. As representative of most companies being subjected to such audits, it is a must to ensure that all proofs or documentation shows a clear directive as to who paid the GST or HST and remittance of the same to the government regardless of the economic condition.

Why The Live CFO is the Best Representation you can have to handle your CRA Audits and Assessments:

We round up the feedback and high praises for the work our managers have done in the past 2 decades and more in representing clients to the CRA. Here are the reasons you may be looking for representation:

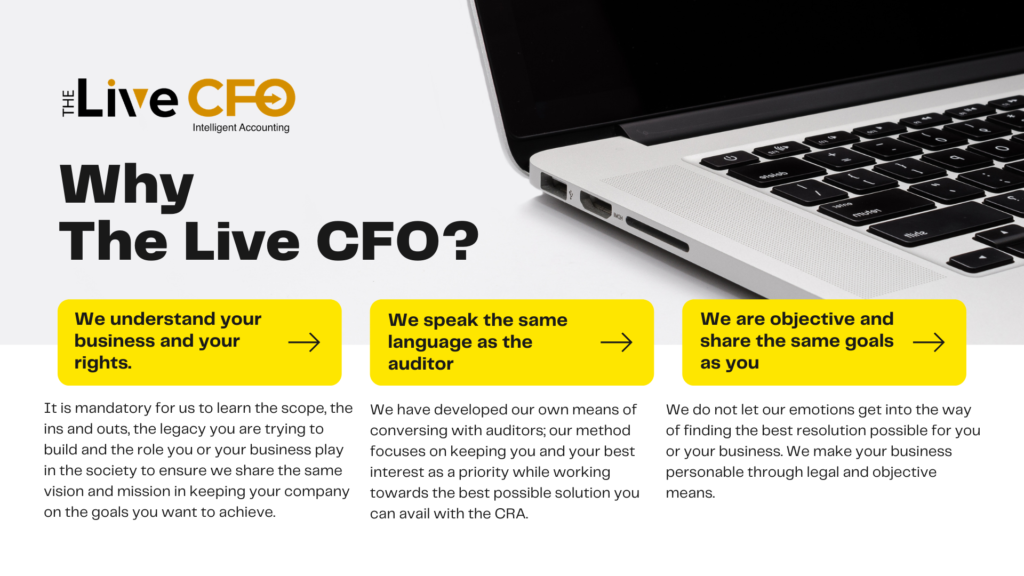

- We understand your business and your rights.

It is mandatory for us to learn the scope, the ins and outs, the legacy you are trying to build and the role you or your business play in the society to ensure we share the same vision and mission in keeping your company on the goals you want to achieve. Our industry experiences ensure that you and your rights are respected and enforced on all fronts. We know when to compromise with the CRA and how to get you the best solution available.

- We speak the same language as the auditor

We have developed our own means of conversing with auditors; our method focuses on keeping you and your best interest as a priority while working towards the best possible solution you can avail with the CRA. It is a must for us to exhaust all possible means to ensure we are on the same page as the auditor and that we both achieve the goals that the government has provided with the goals you are trying to achieve as well. We respect your requests for disclosures and favorable resolutions and we have our own ways in achieving them that you will not find in any other firm than us.

- We are objective and share the same goals as you.

We do not let our emotions get into the way of finding the best resolution possible for you or your business. We share the same sentiments and we ensure that your reputation and established role in the lives of your customers will be highlighted as factors to be considered in our dealings on your behalf. Our clients would share personal experiences where we have given them the best version of the representation they have ever gotten due to our standards and 5 levels of professionalism mandated on all our dealings. We make your business personable through legal and objective means.

We are here to work with you to get the best possible results, ensure your rights are protected and to guide you to the best ways in addressing your tax audit and to negotiate the best possible outcome while you achieve your business goals.

Talk to us!

Send us a message, email or call us!

We are one step away from your coveted peace of mind.